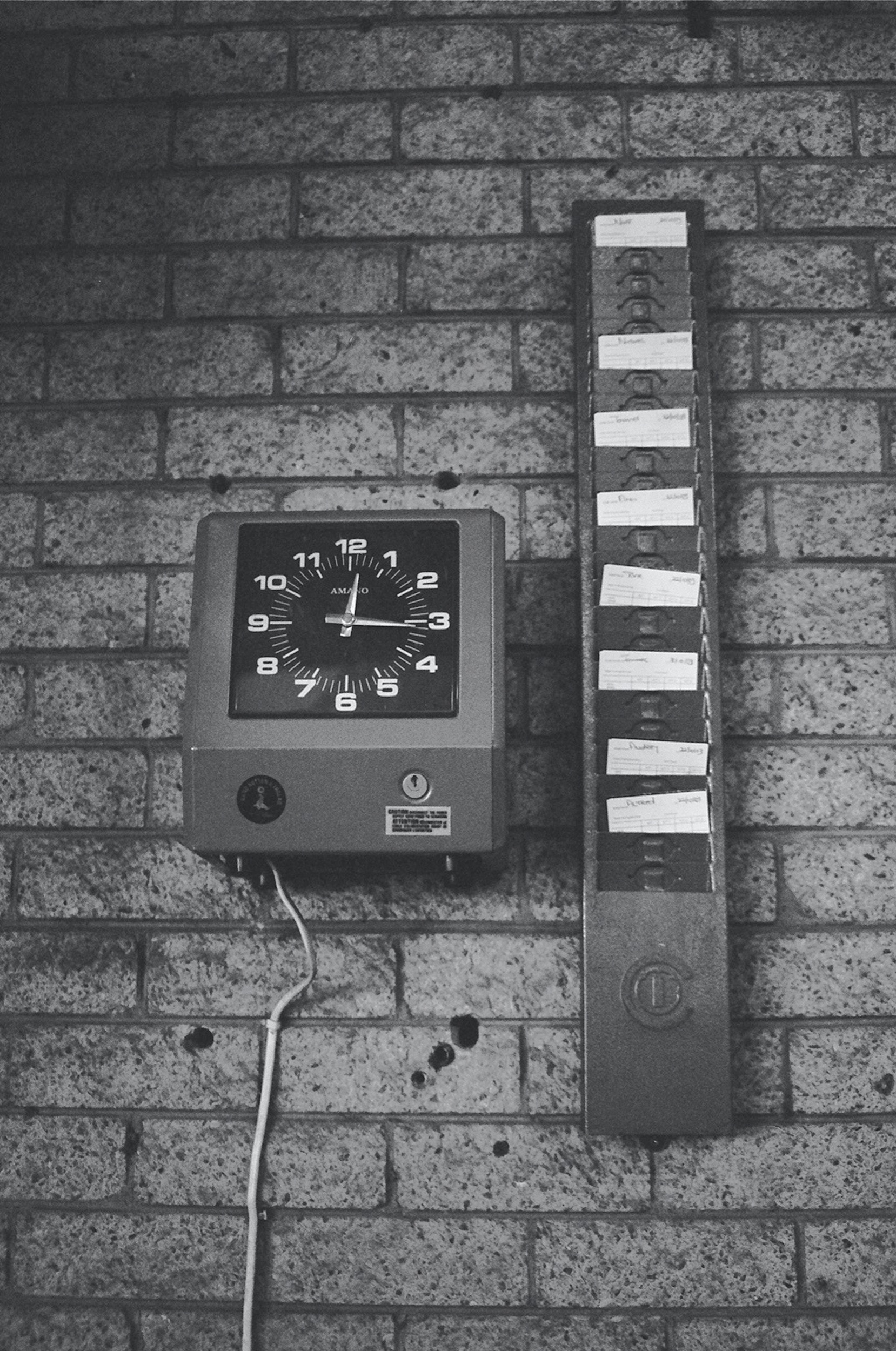

ATTORNEY ADVERTISEMENT Our firm filed a representative action on behalf of Aggrieved Employees and the State of California against Instacart in Santa Clara County in 2018: Ornelas v. Maplebear, Inc. (d/b/a lnstacart), case no. 18CV323046. Based on our client’s experiences, we alleged that lnstacart’s timekeeping app deleted employees’ hours worked on cancelled jobs and failed […]

READ MORE